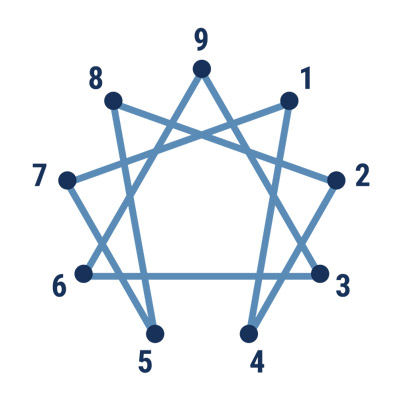

The average person works roughly 91,250 hours in their lifetime. That doesn’t account for overtime, additional part-time work, time spent on continuing education, or the endless hours put into raising a family. That being said, it’s not surprising that when people start getting closer to retirement age, they become confused and overwhelmed. We’re here to help with seven easy steps to prepare for your retirement.

Develop Your Retirement Vision

Do you see yourself hopping in an RV to explore all 50 states? Is the call of the snowbirds enticing you to retire in the south? Or are grandchildren keeping you busy at home? Everyone’s vision of an ideal retirement looks different, but the most important step is having a vision of your own.

Envision the Future of Your Significant Relationships

Many people worry about how their relationships will change once retirement sets in. Maybe you and your significant other have different retirement visions. Or your family isn’t prepared for your post-retirement relocation. Think about your significant relationships and how they will change, then form a plan for dealing with the changes that you envision.

Explore Your Lifestyle Options

There are endless options for what your new lifestyle could be in retirement. Take the time to dig deep and uncover what will make you truly happy and fulfilled. Tap into your passions, values, and “bucket list” items to choose the options that move you toward the lifestyle you desire.

Define your Financial Needs

Did you start saving early for retirement so you could retire in style? Or have risky investments hurt your nest egg? Whatever your retirement plan, make sure you know what lifestyle you can afford to live.

Create your “Retire on Your Own Terms” Roadmap

The roadmap helps you develop a plan for living the life you desire and deserve. Our 8-week “Retire on Your Own Terms” class helps attendees explore their retirement vision and develop the roadmap that will help get them there.

Discuss Your Action Plan

Now that you have your vision and roadmap, it’s time to make sure that you’re taking the right actions to get you there. Whether you talk with your financial planner or get one-on-one coaching with Transform’s certified retirement coach, your action plan is most effective when it’s set sooner rather than later.

Initiate Your Action Plan

Once your action plan is in place, it’s time to get to work! (pun intended) Work your steps to get to your retirement goal!

If you’re still feeling overwhelmed, don’t worry. We’re here to help with one-on-one coaching, classes, and other resources to help you retire on your own terms.